Most vision plans cover prescription sunglasses, but coverage varies by plan and network.

You want clarity before you buy. Are prescription sunglasses covered by insurance? I’ve helped many patients use their vision benefits and avoid surprise bills. In this guide, I break down what most plans cover, what they deny, and how to get the most value. If you’ve wondered, are prescription sunglasses covered by insurance, you’ll find plain-English answers, examples, and pro tips you can use today.

How vision insurance treats prescription sunglasses

Vision insurance is built around an allowance and a benefit period. Most plans treat prescription sunglasses like a second pair of glasses. Your benefits can apply to frames, lenses, and many lens options. The catch is the allowance and the rules.

Here is how it usually works at in-network providers:

- Frame allowance applies to sunglass frames. You pay any amount over the allowance.

- Standard lenses are often covered with a copay or discount. Single vision is the least costly. Progressives and specialty lenses cost more.

- Lens enhancements like polarized, UV, and scratch coats may be covered with set copays. Premium options can have higher copays.

- Frequency limits apply. Many plans allow one set of frames and lenses every 12 or 24 months.

If you are thinking, are prescription sunglasses covered by insurance, the short answer is yes, but the details matter. Plans differ on brands, add-ons, and timing.

Types of plans and how they handle coverage

Not all insurance works the same. This is where most confusion starts. People ask, are prescription sunglasses covered by insurance, and the answer depends on the plan type.

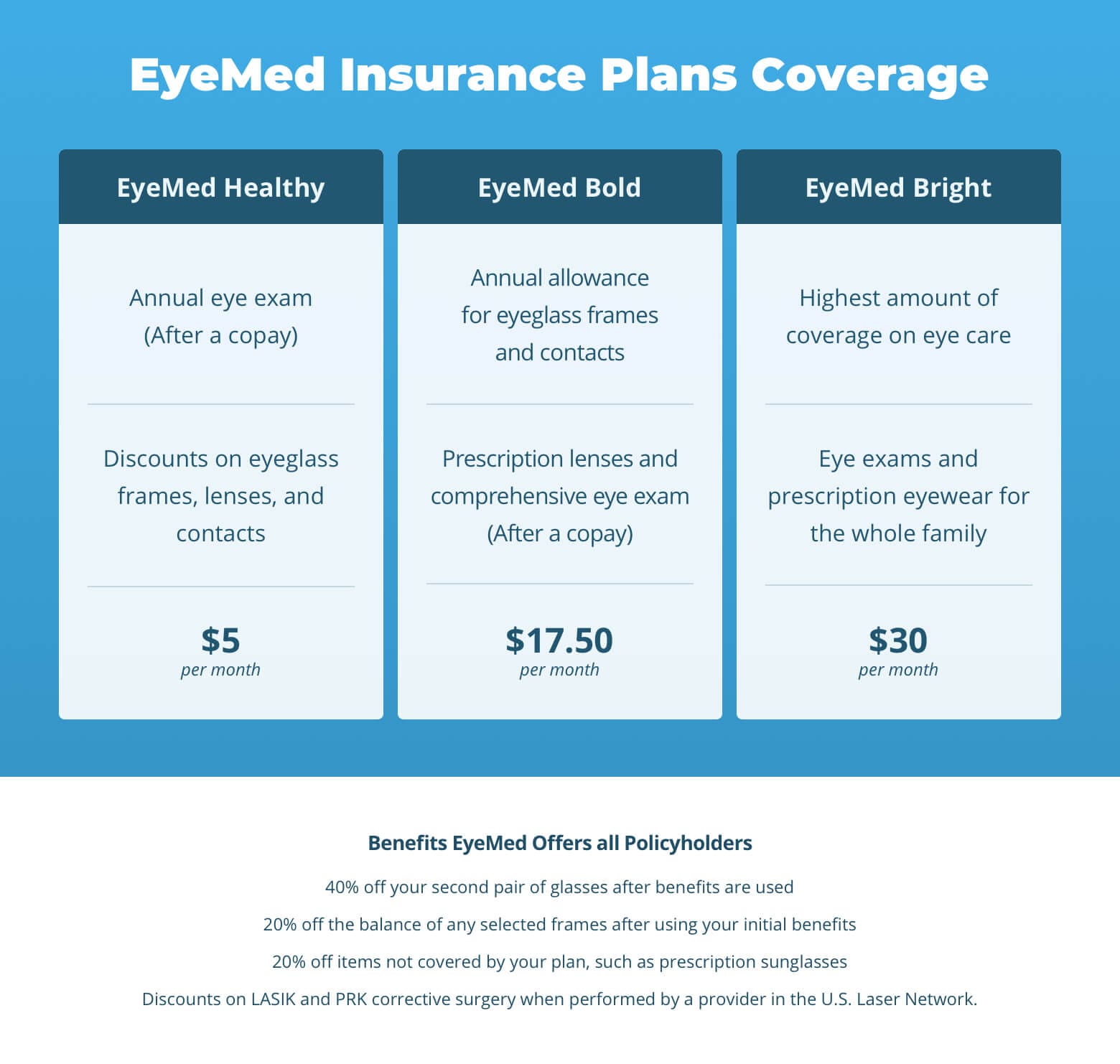

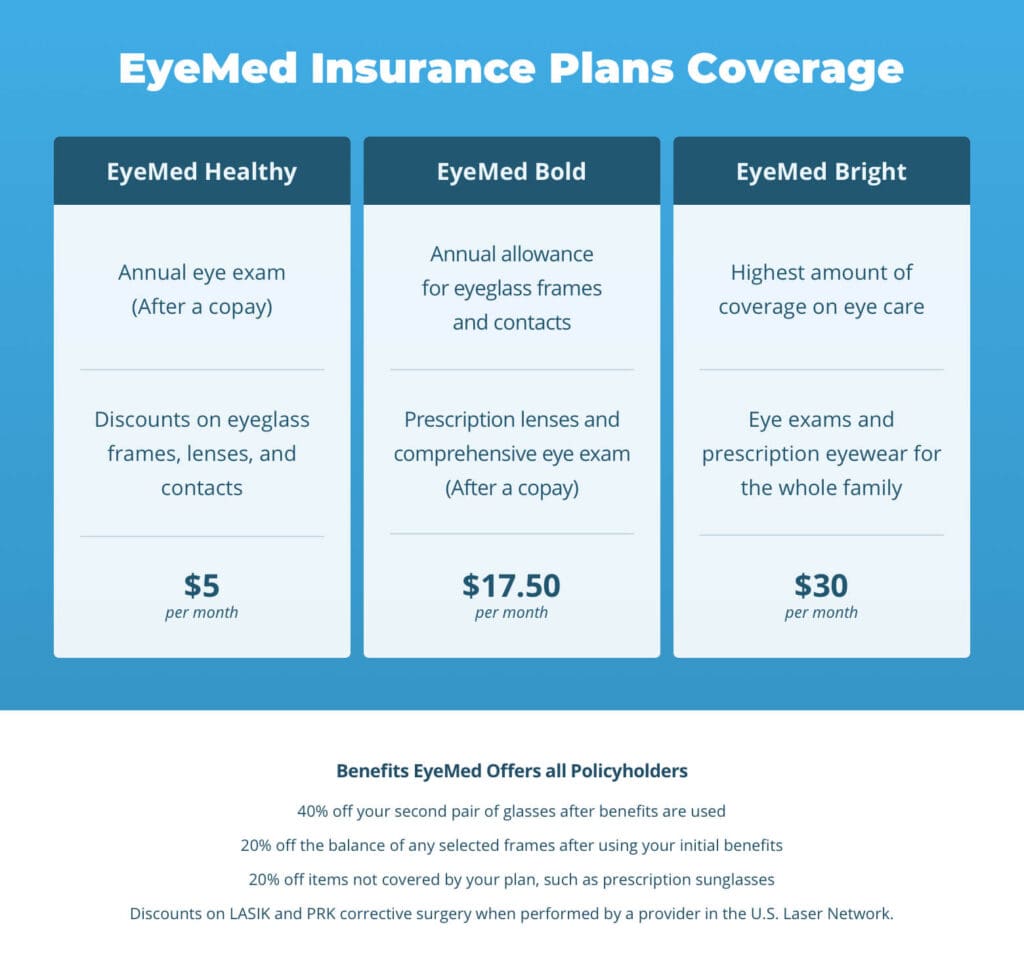

- Standalone vision insurance. Plans like VSP or EyeMed often cover prescription sunglasses with an allowance and copays for lens options.

- Employer vision benefits. Many employers fund the same style of benefit. Some add a “second-pair” discount.

- Medical insurance. Medical plans rarely cover routine sunglasses. They may pay only if there is a medical need for special tints.

- Medicare. Original Medicare does not cover routine eyewear. Some Medicare Advantage plans include a vision allowance that can be used for prescription sunglasses.

- Medicaid. Coverage varies by state. Many states cover basic glasses for adults or kids. Sunglasses may be allowed only with medical need.

- Marketplace (ACA) plans. Adult routine vision is plan-specific. Pediatric vision is required, but sunglasses are not always included unless medically necessary.

In my experience helping patients choose, the best clue is your benefit summary. If you still wonder, are prescription sunglasses covered by insurance under your plan, call your insurer or ask your in-network optician to verify.

What is usually covered and common limits

Most vision plans cover these items for prescription sunglasses:

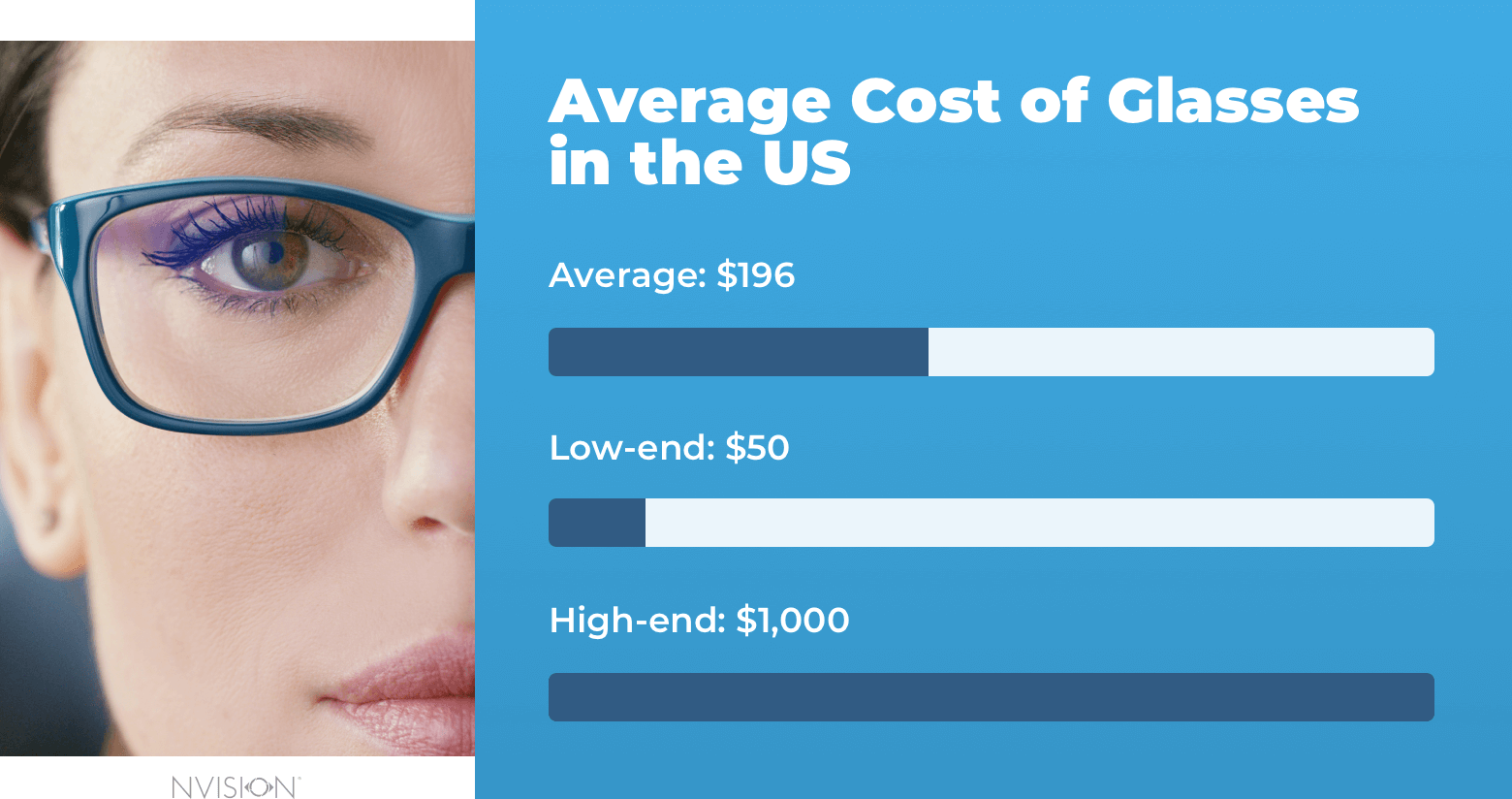

- Frame allowance. A set dollar amount, often $120 to $200.

- Standard lenses. Single vision covered with a copay. Bifocal and progressive with higher copays.

- UV protection. Often included or low-cost.

- Polarized lenses. Usually covered with a copay because they reduce glare and eye strain.

- Photochromic (light-adaptive). Often discounted or covered with a copay.

Common limits to expect:

- Frequency. One pair of frames and lenses every 12–24 months.

- Brand and network. In-network brands often cost less and use your full benefit.

- Dollar caps. Allowance applies once per period. Upgrades may have set copays but can stack up.

- Duplicate pairs. Some plans limit you to one pair per period unless you pay cash.

People ask me all the time: are prescription sunglasses covered by insurance if I already bought regular glasses this year? Often yes, but only if your plan allows a second pair in the same period or if you pay out-of-pocket for frames and use benefits for lenses.

What is not covered or often denied

Plans draw lines between medical need and style. That is where denials happen. If you wonder, are prescription sunglasses covered by insurance when they are luxury or designer, the plan may only pay up to the allowance.

Common denials include:

- Non-prescription sunglasses. These are usually not covered.

- Cosmetic tints without a prescription. Some plans want medical need for very dark or specialty tints.

- Designer frames above allowance. You pay the difference.

- Out-of-network purchases without proper claim forms. Many plans reimburse less out of network.

- Multiple pairs within the same benefit period. Unless your plan includes a second-pair benefit, this can be denied.

I have seen claims denied because the invoice did not label lenses as prescription. If you are asking, are prescription sunglasses covered by insurance for me, make sure your receipt lists the prescription lens type and your Rx.

How to maximize your benefits

You can cut your out-of-pocket cost with a few smart moves. This is where careful timing and network choices pay off. If your question is, are prescription sunglasses covered by insurance in full, the answer is usually no, but you can come close.

Practical tips:

- Stay in network. You get the full allowance and lower copays.

- Use your frame allowance on sunglasses if your daily glasses still work.

- Time your purchases. Get regular glasses at the end of one period and sunglasses at the start of the next.

- Apply FSA or HSA funds. These pay for what insurance does not cover.

- Ask for medical necessity if you have light sensitivity, migraines, or eye disease. Your doctor can note why certain tints are needed.

- Compare lens options. Polarized lenses cut glare more than simple tints and are worth the copay for driving and outdoor use.

- Ask about package pricing. Many offices offer second-pair bundles for sunglasses.

I once helped a teacher split her benefits. She used her allowance on polarized prescription sunglasses first. Three months later, in a new benefit year, she used her frame benefit for computer glasses. She started by asking, are prescription sunglasses covered by insurance if I buy them first? The answer was yes, and timing saved her over $200.

Cost examples and real-world scenarios

Numbers help. Here are simple, common cases. People often ask, are prescription sunglasses covered by insurance enough to make them affordable? These snapshots show what to expect.

In-network, single vision, mid-range frame:

- Frame price $200. Plan allowance $150. You pay $50.

- Lenses $120. Copay $25.

- Polarized upgrade $75 copay.

- Total out-of-pocket about $150.

In-network, progressive lenses, premium options:

- Frame price $250. Allowance $150. You pay $100.

- Progressive lens copay $120.

- Polarized and AR coatings $120 in set copays.

- Total out-of-pocket about $340.

Out-of-network online purchase:

- Total price $220.

- Plan out-of-network reimbursement $70.

- Your net cost $150.

- Note: Claims must include Rx proof and itemized receipt.

In every case above, the real answer to are prescription sunglasses covered by insurance is yes, but you still share the cost. The allowance and copays shape the final price.

Filing a claim step by step

A clean claim gets paid faster. If you think, are prescription sunglasses covered by insurance when I buy online, follow your plan’s steps and keep records.

Do this:

- Verify benefits first. Ask about frame allowance, lens copays, and upgrades.

- Choose in-network if possible. The office often files for you.

- Keep an itemized receipt. It should list frames, lens type, and options.

- Submit any out-of-network form. Attach the receipt and your Rx details.

- Track timelines. Many plans have a 90–180 day window to file.

- Save your EOB. Check it for correct allowances and copays.

If a claim is denied, call and ask why. Then ask, are prescription sunglasses covered by insurance under a different code or with medical notes? A simple correction can fix many denials.

Special cases: medical insurance, Medicare, Medicaid, HSA/FSA

Medical plans pay for diagnosis and treatment. They do not pay for routine sunglasses. But there are exceptions. People still ask, are prescription sunglasses covered by insurance if I have an eye disease?

Here is the short take:

- Medical necessity. If you need special tints for conditions like aniridia, albinism, or post-surgery light sensitivity, a doctor letter may help. Some plans will cover the lens tint or a medical filter.

- Medicare. Original Medicare does not cover routine eyewear. Medicare Advantage often includes a vision allowance usable on prescription sunglasses.

- Medicaid. State rules vary. Many cover glasses for children. Sunglasses may be covered only with a medical reason.

- Workers’ comp. If you need safety sunglasses for a job-related eye injury, coverage may apply.

- HSA and FSA. Prescription sunglasses are eligible expenses. Use them to cover what insurance will not.

If you are still unsure and wonder, are prescription sunglasses covered by insurance for my case, ask your eye doctor to note medical needs in your chart and on the claim.

Frequently Asked Questions of are prescription sunglasses covered by insurance

Are prescription sunglasses covered by insurance at most vision plans?

Yes, many vision plans cover them with a frame allowance and lens copays. Coverage depends on network, frequency, and lens options.

Are prescription sunglasses covered by insurance if I already used my glasses benefit?

Sometimes. Some plans allow a second pair in the same period, but many limit you to one set of frames and lenses per cycle.

Are prescription sunglasses covered by insurance when I buy online?

Often yes, but usually as out-of-network. You will need an itemized receipt and may get a set reimbursement amount.

Are prescription sunglasses covered by insurance under Medicare?

Original Medicare does not cover routine sunglasses. Many Medicare Advantage plans include a vision allowance that you can use.

Are prescription sunglasses covered by insurance if I need special medical tints?

They may be with medical necessity. A doctor letter can help for glare disability, light sensitivity, or certain eye conditions.

Are prescription sunglasses covered by insurance for kids?

Pediatric vision benefits vary by plan and state. Many cover glasses, and sunglasses may be covered if medically necessary.

Are prescription sunglasses covered by insurance with HSA or FSA funds?

You can use HSA or FSA for prescription sunglasses. These accounts can cover what your insurance does not pay.

Conclusion

Prescription sunglasses protect your eyes, reduce glare, and make driving safer. For most people asking, are prescription sunglasses covered by insurance, the answer is yes, with limits. Know your allowance, stay in network, and time your purchases to stretch your dollars.

Use your benefits and your HSA or FSA to fill the gaps. Ask your provider to verify coverage before you buy. Ready to take the next step? Review your plan, call your eye doctor, and share your needs. Subscribe for more smart eye-care guides or drop a question in the comments.

Rubel Miah is the Senior Editor at MyStyleGrid.com, where he brings a sharp editorial eye and an unshakable love for fashion to everything he does. A true style addict, Rubel lives and breathes trends, from streetwear to high fashion, and has a knack for turning inspiration into impactful stories. With years of experience in fashion journalism and digital media, he curates content that empowers readers to express themselves through style. When he’s not editing features or forecasting the next big thing, you’ll find him hunting down vintage pieces or capturing street style moments around the city.